Step-by-Step Guide to Learning Forex Trading

Forex trading can seem daunting at first, but with the right knowledge and guidance, it can become an exciting and profitable endeavor. In this article, we will walk you through the essential steps to learn forex trading effectively. Additionally, if you’re looking for reputable brokers, check out the learn forex trading step by step Best Vietnamese Brokers to get started.

Understanding Forex Trading

Forex, or foreign exchange, is the largest financial market globally, where currencies are traded. Unlike stocks or commodities, forex trading occurs 24 hours a day, five days a week, across various global markets. Understanding the basics of forex trading is crucial for anyone looking to enter this market.

Key Terms to Know

- Currency Pair: A quotation of two different currencies, with the first currency as the base and the second as the quote.

- Pips: The smallest price move that a given exchange rate can make, typically the fourth decimal place.

- Leverage: This allows traders to control a large position with a relatively small amount of capital.

- Spread: The difference between the bid price and the ask price of a currency pair.

Step 1: Educate Yourself

The first step to becoming a forex trader is education. This involves understanding various aspects of the market, strategies, and risk management. Here are a few resources you might consider:

- Online courses and webinars specifically focused on forex trading.

- Books on trading strategies and market analysis.

- Forex trading forums and communities where you can learn from experienced traders.

Step 2: Choose a Trading Style

Forex trading offers various styles, and it’s essential to choose one that suits your personality and lifestyle. Common trading styles include:

- Day Trading: Buying and selling currency pairs within the same day.

- Swing Trading: Holding positions for several days to take advantage of short-term market movements.

- Scalping: Making numerous small trades throughout the day for small profits.

Understanding these styles will help you determine which strategy aligns best with your goals and risk appetite.

Step 3: Create a Trading Plan

A well-defined trading plan is crucial for success in forex trading. Your plan should outline:

- Your trading goals.

- The markets and currency pairs you want to trade.

- Your risk tolerance and money management rules.

- The strategies and indicators you plan to use for trading decisions.

Having these elements in place will keep you focused and disciplined as you trade.

Step 4: Open a Trading Account

After you have gathered adequate knowledge and crafted your trading plan, it’s time to open a trading account with a forex broker. Consider the following factors when choosing a broker:

- Regulation and reputation.

- Trading fees and spreads.

- Available trading platforms and tools.

- Customer service and support options.

Once you select a broker, you can set up a demo account to practice trading without risking real money.

Step 5: Practice with a Demo Account

A demo account is one of the best tools for new traders. It allows you to practice trading with virtual money, helping you to gain experience without financial risk. Use the demo account to test your trading strategies, familiarize yourself with the trading platform, and build your confidence before transitioning to live trading.

Step 6: Analyze the Market

Successful forex trading relies heavily on market analysis. There are two primary types of analysis you need to focus on:

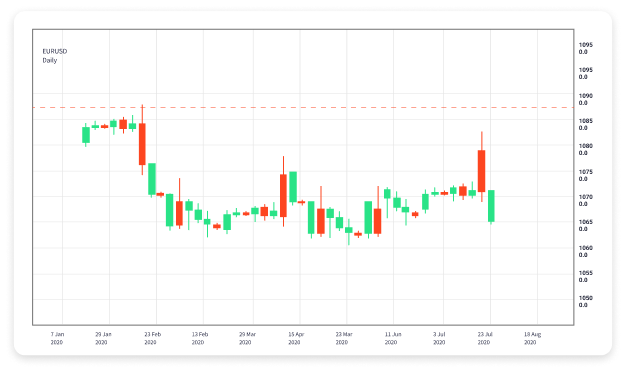

- Fundamental Analysis: Evaluating economic indicators, news events, and geopolitical factors that can influence currency movements.

- Technical Analysis: Using historical price data and charts to identify patterns and trends. Popular technical indicators include moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Combining both analysis methods can provide a more comprehensive understanding of the market.

Step 7: Manage Your Risk

Risk management is one of the most critical aspects of trading. Without proper risk management, even the best trading strategy can lead to substantial losses. Here are some risk management techniques:

- Only risk a small percentage of your trading capital on any single trade (typically 1-2%).

- Use stop-loss orders to limit potential losses on trades.

- Avoid trading in highly volatile market conditions unless you have a clear strategy.

By adhering to risk management rules, you can help protect your trading capital while increasing your chances of success.

Step 8: Start Live Trading

Once you feel confident in your skills and have tested your strategies in a demo account, it’s time to start trading with real money. Begin with a small amount that you can afford to lose, and gradually increase your trading size as you gain experience. Remember to stick to your trading plan and continuously evaluate your performance.

Continuously Improve Your Skills

The forex market is ever-evolving, and as a trader, it’s essential to stay updated with the latest trends, news, and strategies. Participate in trading communities, read trading books, and attend webinars to continue your education and refine your trading techniques.

Conclusion

Learning forex trading step by step requires dedication, education, and practice. By following these steps, you can build a solid foundation in forex trading and increase your chances of success in this dynamic financial market. Always remember to trade responsibly and continuously seek to improve your trading skills.