Content

The degree of their deduction will be deducted in the other levels of money noted on outlines 8b due to 8z. For many who obtained jobless payment in the 2024, a state will get thing an electronic Mode 1099-Grams rather than it are sent for your requirements. Look at your country’s jobless compensation site to find out more.

Pokie mate casino: Unmarried and you can Partnered Filing Together

Particular laws and regulations apply to know if you are a citizen alien, nonresident alien, otherwise dual-position alien. Very nonresident aliens and you will dual-status aliens provides various other submitting conditions and may need to file Mode 1040-NR. 519 discusses these types of requirements or any other advice to assist aliens comply with You.S. taxation laws.

Line 13 – Federal Modified Gross income (AGI) from government Function 1040 or Setting 1040-SR, range eleven

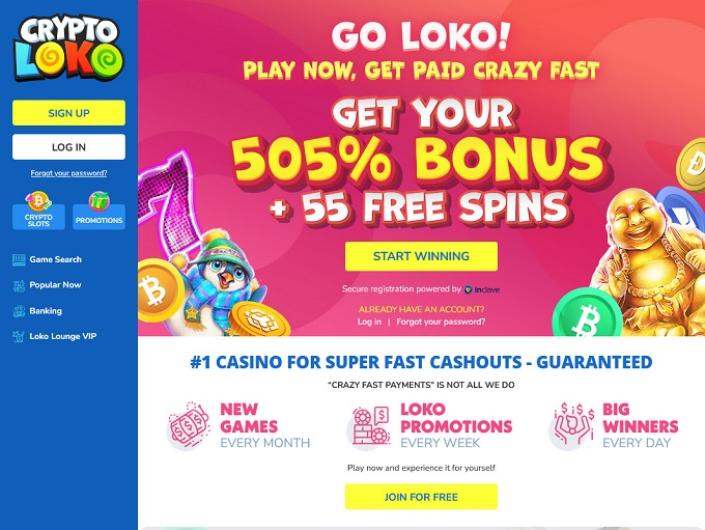

In that way, you’ll have the funds to cover one relevant taxation loans. For pokie mate casino many who’re also looking a different checking account, think if your’lso are better off looking for other lender one will pay more desire. Financial institutions fool around with signal-up bonuses to distinguish by themselves away from anyone else in the business. Cash bonuses as well as let financial institutions bring in clients and the brand new dumps.

They’re able to document a combined get back whether or not only 1 got money or if perhaps they failed to live together with her all-year. When you file a mutual come back, you can not love to file separate efficiency for the seasons immediately after the brand new deadline of the get back. If you decide to mail your go back, you need to use specific personal delivery functions appointed by Internal revenue service to fulfill the brand new “prompt emailing managed because the quick filing/paying” laws to own tax returns and you can payments. These personal birth characteristics tend to be just the following the. That it extension offers an additional two months so you can file and you will afford the tax, however, attention will be billed regarding the unique due date away from the newest get back for the any outstanding income tax.

When this code enforce, the brand new expidited CCA manage implement according away from a qualified assets on a single prorated basis and you may would not be for sale in the following income tax year according of the house. Being qualified nutrient issues create add extraction; specific handling issues from the exploit or well web sites, tailing ponds, mills, smelters, otherwise refineries; certain recycling cleanup things; and you will particular graphite items. The brand new federal Minister from Fund perform next see whether the newest standards were fulfilled and you can, if so, perform employ the newest province otherwise area. In order to qualify for the brand new 15-per-penny Brush Electricity money taxation borrowing from the bank, the newest recommended work criteria currently ahead of Parliament within the Statement C-59 to have prevalent earnings and apprenticeships would have to getting came across.

SoFi’s Atm formula are susceptible to alter at the our discretion from the at any time. For many who’re looking for a near risk-100 percent free investment automobile, you’lso are bound to have come round the repaired dumps, Singapore Discounts Bonds (SSB) and Treasury costs (T-bills). If you’re also an everyday customers, you’ll only be capable of getting a speed of just one.80% p.an excellent. And, you just obtain the large costs if you’re a priority individual banking buyers, we.e. that have a certain high internet well worth. If you need large cost, consider the financial institution out of China (dos.10% p.an excellent.) or ICBC (dos.15% p.a good.) with just $five hundred to possess a step three-week tenor. An informed circumstances situation is if you are a top otherwise Largest Professional buyers which even offers investments having HSBC.

If you are hitched filing a new go back, go into your partner’s identity from the entry space underneath the submitting status checkboxes rather than below your identity. If you are already incarcerated, get into your own inmate identifying count near the history term. So you can amend from independent taxation statements to a combined taxation come back, pursue Form 540 instructions to accomplish only 1 revised income tax go back. To switch to a shared tax return, you and your spouse/RDP have to have started lawfully partnered or even in a keen RDP for the the last day’s the newest taxable seasons. Fundamentally, for individuals who submitted government Mode 1040-X, Amended You.S. Individual Tax Come back, file a revised California taxation go back within six months except if the new transform don’t connect with your California tax responsibility. Document an amended go back just once you have recorded your own unique or before filed California tax return.

Because the 2001, AFG features assisted firefighters or any other earliest responders see significantly expected tips very important to securing the public and you will crisis staff of flame and associated problems. The federal government intends to propose amendments to the Earliest Countries Products and you will Features Income tax Work to allow Reality conversion taxes and you may streamline management of fees below you to Operate. A lot more engagement and you can settlement out of tax management agreements will be necessary before implementation of well worth-additional Truth taxation by the curious Native governments. So it suggested boost could apply to the additional responsibility implemented according of performing jurisdictions within the paired vaping tool taxation structure.

Line 101 – Overpaid Income tax

We are a separate, advertising-offered analysis service. It is rather very important one 5 pound deposit harbors appear in every differences. People can select from ports which have 3 reels, 5 reels, otherwise deposit £5 get £ % 100 percent free ports. Many of these names render a £5 lay extra, enabling people to invest longer to their favorite video game.

You are as well as included in an agenda if perhaps you were mind-functioning together with a september, Effortless, or accredited later years package. On the web 19c, go into the few days and you will year of the brand new separation and divorce contract one to means that it deduction to have alimony paid. When you are a partner, the insurance policy will be in a choice of your own label or even in the new identity of your union.

A 5-per-cent borrowing rate will be available in case your work conditions try not met. A broad list of possessions is actually qualified assets, along with common money, in public exchanged bonds, authorities and corporate ties, and you may guaranteed investment permits. Waits in the acquiring notice away from a kid’s demise can cause the brand new clawing back from CCB payments according of one’s lifeless son for some months immediately after its demise. A good CCB person becomes ineligible to the CCB in respect from a child the new week following the child’s dying.

A rely on holder is choose as numerous beneficiaries because they such; however, to own deposit insurance intentions, a rely on account holder one to identifies five or more eligible beneficiaries are not covered beyond $1,250,100000 for every financial. Inside the calculating publicity, a beneficiary only counts just after for each and every holder, even if the same beneficiary is roofed multiple times to the believe profile in one lender. Marci Jones provides five Solitary Accounts in one covered financial, along with you to membership in the term from their sole proprietorship. The newest FDIC makes sure places belonging to a just proprietorship while the a good Solitary Account of the business owner.