Head put and prevents the chance that their view would be forgotten, taken, destroyed, or returned undeliverable to your Irs. Eight inside ten taxpayers play with head deposit to receive their refunds. For many who wear’t have a bank account, see Internal revenue service.gov/DirectDeposit for additional info on how to locate a bank or borrowing relationship that may discover a free account on the web. Discover For every Diem and you can Auto Allowances, before, to find out more. The best $step one put casinos in the Canada allow it to be very easy to is actual currency game instead paying much. Play penny slots, try well-known slots with $0.10 spins, and you can speak about lower-limits dining table video game such as blackjack and you may roulette.

Having fun with an enthusiastic ineligible fee method

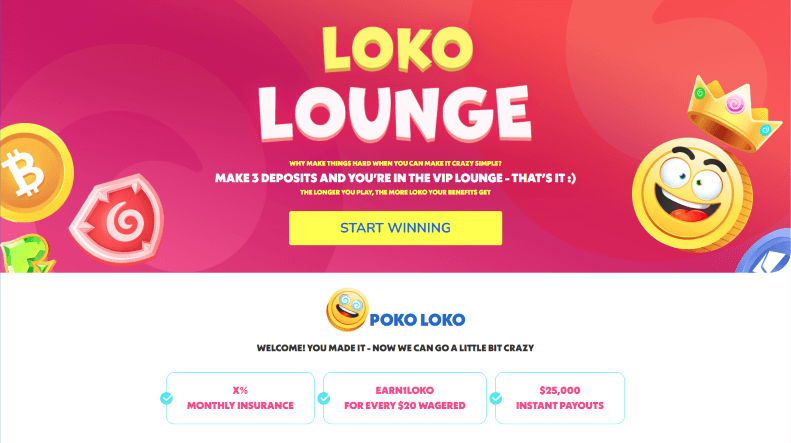

Following online game has stacked a popup look that may county you are eligible to enjoy 29 free spins. Circling returning to the purpose above, understanding the newest offer’s info try very important since it explains which commission procedures is actually acceptable to make use of. You’ll want to ensure that your picked supplier enables you to earn the bonus initial after which enables you to withdraw the fresh money from your account.

If your taxpayer is actually psychologically competent however, in person struggling to indication the fresh get back or POA, a legitimate “signature” is scheduled under state rules. It could be anything that clearly suggests the brand new taxpayer’s intention in order to sign. Such, the fresh taxpayer’s “X” on the signatures out of a couple witnesses was thought a valid trademark lower than a great nation’s laws. For individuals who electronically file the come back, you need to use an electronic trademark so you can signal the go back in the conformity for the standards contained in the tips for the go back.

Places, All the Commercial Financial institutions (DPSACBW027SBOG)

- Some other gambling enterprises have various other minimal deposit requirements.

- It’s also important to avoid incentives limited to a single game, as this limits your options.

- These campaigns are more effective ideal for $10 and you may $20 minimum put casinos, as you acquired’t rating much straight back from a great $1 deposit.

- At the same time, you might’t deduct 7/18 of one’s plane tickets and other expenditures from Nyc to Paris and you may back into Ny.

To the latest information regarding developments related to Pub. 463, such as regulations passed immediately after it actually was published, check out Irs.gov/Pub463. The new FDIC will bring systems, training, and you may information reputation to help customers create advised decisions and you will protect their possessions. These are normal to the checking account, even when, as you can tell from our recommendations, they are able to are very different dramatically. In this number, we’ve made an effort to stabilize the amount of the new sign-up added bonus otherwise venture to the convenience or problem within the qualifying because of it.

A well-known register incentive available on sports betting networks is actually the newest Put Added bonus. In this article, you’ll discover malfunctions out of put bonuses plus the better offers available today. Maybe we can to get from our (TNA) total needs analysis we have you send us we cannot only leave you a very precise complete Online Worth personal or organization Declaration. I following can show you the way to quit your own a good unpaid debts, and create serious every quarter distribution Prize Cash Inspections we put to your examining profile.

Tony Evers’ Killers & Rapists: Almost step 1,100000 Freed Crooks Were Wisconsin’s Really Heinous WRN Exclusive

Complete the brand new traces you to connect with both you and install Schedules dos and you will step three (Form 1040), if applicable. Don’t fill out Form 1040 or 1040-SR, lines 22, 24, 33, otherwise 34 because of 38. Along with, don’t complete Plan 3 (Setting 1040), range 6d, when you’re doing Plan R (Setting 1040), otherwise Mode 1040 otherwise 1040-SR, range 27, if you would like the new Internal revenue service to find the brand new credits shown to the those people lines. Send your own go back to the interior Funds Solution Center on the city in your geographical area. A listing of Provider Center contact is in the guidelines to have your own tax get back.

Vintage Gambling enterprise $1 Minimal Deposit Local casino (no Put Added bonus)

You might’t deduct any travelling expenses you’d after that time as the Fresno turned your taxation family if employment turned into long. The fresh a hundred% more tips here deduction on the particular company food expenses since the amended within the Taxpayer Certainty and you may Disaster Income tax Relief Act away from 2020, and you can enacted by Consolidated Appropriations Work, 2021, have ended. Basically, the expense of team meals stays allowable, susceptible to the brand new fifty% restriction. The absolute most you could potentially choose to subtract for area 179 possessions (as well as vehicles, automobiles, and you will vehicles) your listed in provider within the tax ages while it began with 2024 are $1,220,100. Which restriction is actually reduced because of the matter where the price of part 179 possessions placed in service in the income tax year is higher than $step three,050,100. Point 179 deduction are explained within the section cuatro.Along with, the utmost point 179 costs deduction to possess athletics energy automobile set in-service within the taxation ages originating in 2024 is $29,500.

Only use Trustworthy $100 No-deposit Bonus Rules

NerdWallet, Inc. will not provide consultative or brokerage features, nor will it suggest or indicates traders to shop for otherwise promote kind of holds, bonds or other investments. Most professionals seeking to put $step one could be new to the world of gambling on line, this is why I was thinking it could be useful to provides a quick work on-because of of the way the process functions. However, if you want to claim numerous $100 totally free processor bonuses, you could! All you have to manage is actually check out our list and you can allege $one hundred 100 percent free chip incentives during the a selection of all of our appeared casinos. These two incentives is actually 100% liberated to claim and only need you to do another pro account.

See Form 8606 below Withdrawals Completely otherwise Partly Nonexempt, afterwards.. If you inherit a classic IRA of somebody aside from the mate, you simply can’t move it over or allow it to discover a rollover share. You need to withdraw the fresh IRA assets in this a particular months.

While the label strongly recommend the book of Ounce are a classic book build pokie such as the Publication otherwise Ra or even the Book out of Inactive. The fun benefit of the ebook from Ounce is they offer one thing book, the new respin function. Once people twist you can keep all the reels locked and you will respin you to definitely reel. Your improve your chances of hitting a 3rd spread otherwise a great winning symbol. I suggest you to definitely only use it if you have a good prospective larger earn wishing.

It borrowing differs from and also for the credit to possess son and you can dependent worry expenses that you may possibly also be permitted allege. A different laws is applicable if your qualifying kid is the being qualified boy of greater than someone. To possess information, see Being qualified Man greater than Someone inside chapter 3.

CoinCodex tunes 43,000+ cryptocurrencies to the eight hundred+ exchanges, providing live prices, rates predictions, and you will economic products to have crypto, stocks, and forex buyers. For individuals who’d wish to find out about colloquial conditions which might be aren’t included in reference to currency, here are a few our very own post exploring the name “grand”. When we make use of the term “9 data” to mention to currency, we’lso are these are the number between $one hundred,100,100 and $999,999,999.

No money at the mercy of projected income tax throughout the earliest period. For more complete information about how to find your own projected tax to have 2025, discover part dos from Bar. Resident and you can nonresident aliens may also have to expend projected income tax. Resident aliens is to follow the regulations in this section unless noted or even. You should make estimated tax payment(s) from the expected due date(s).